Quick hits:

What is bank advertising?

What does digital marketing do for banks?

Bank advertising is the practice of raising awareness about banking products and services. Its primary purpose is to drive customer acquisition by building trust and credibility with the bank’s target customers.

Digital marketing can help banks reach their target customer in a more efficient and cost effective manner. It allows banks to display targeted ads to users searching for relevant keywords, or who may be interested in their products or services.

How do you advertise a bank?

How much do banks spend on advertising?

To successfully advertise a bank, you must first understand your target customer, their needs, and where they spend their time online. Then, banks must determine the best medium to reach those target customers: SEO and content marketing, Google ads, Email, and Social Media as examples.

Generally, a bank will spend between 0.1% to 0.5% of its Cash on Hand in marketing efforts. For national bank advertising, this translates to roughly $1.5 billion annually. Credit Union marketing usually includes .12% of total assets on advertising campaigns.

Advertising guidelines for banks: Compliance

The first step in starting your advertising campaign is making sure your banking institution is compliant with the FDIC.

To do so, Banks should first avoid any act that could be considered anticompetitive, unfair, deceptive, or injurious to the public (aka your target audience).

Each insured depository institution must include the official FDIC advertising statement in all of its advertisements that either promote deposit products and services or promote non-specific banking products and services.

Member of the Federal Deposit Insurance Corporation (FDIC).

(Official FDIC advertising statement)

Advertising guidelines for banks: marketing & messaging

Now we get to the fun stuff. When looking at building an advertising campaign, Banks in particular have a few key tasks their marketing materials need to accomplish.

1. Build trust: The financial industry continues to face public skepticism. It’s not hard to see why, with Silicon Valley Bank’s failure, the crash of Cryptocurrencies, and frequent stories of banks breaching fiduciary duty. Successful bank marketers prioritize transparent communication about the bank’s ethical practices, and align advertising messages with actual offerings, and will stay away from any potentially misleading content.

Pro tip: Don’t try to get cute with your offerings. Just be honest. It goes a long way.

2. Be relatable: When banks present themselves in a relatable manner, they can humanize their brand in the eyes of their target customer and show that the bank understands and empathizes with their customers’ experiences.

Pro tip: Own your warts. Often brands want to hide behind a facade of perfection, when all that does is alienate your audience. People can smell “fake” a mile a way. Be authentic.

3. Be creative, but get your point across: Creative marketing campaigns have the power to spark emotional responses and encourage customers to engage with the brand. But if you get too creative, you run the risk of losing the whole message behind your ad.

Pro tip: Don’t confuse your target customer. If you end up confusing them, you’ll have just wasted precious marketing budget for nothing.

4. Showcase tech-savviness: Customers expect convenience and seamless digital experiences–secure, digital experiences. By demonstrating tech-savviness in their marketing campaigns, banks show that they can meet these expectations and keep their customers’ data secure, simple as that.

Pro tip: Sometimes less is more. Customers spend money to make their lives easier. If you can showcase how you do that, you’ll be in a good spot.

5. Make your ads relevant: By tailoring messaging to resonate with a target audience, banks can highlight how they understand their customers’ needs, challenges, and aspirations. This leads to much better performance in marketing, and higher ROI (return on investment).

Pro tip: Start by segmenting your existing customers into cohorts. What demographics do they share? What interests? What problems? What goals?

How to see what competitors are doing with their ads

We’re going to pull the curtain back on how expert digital marketers find out what your competitors are doing online, and how you can take advantage.

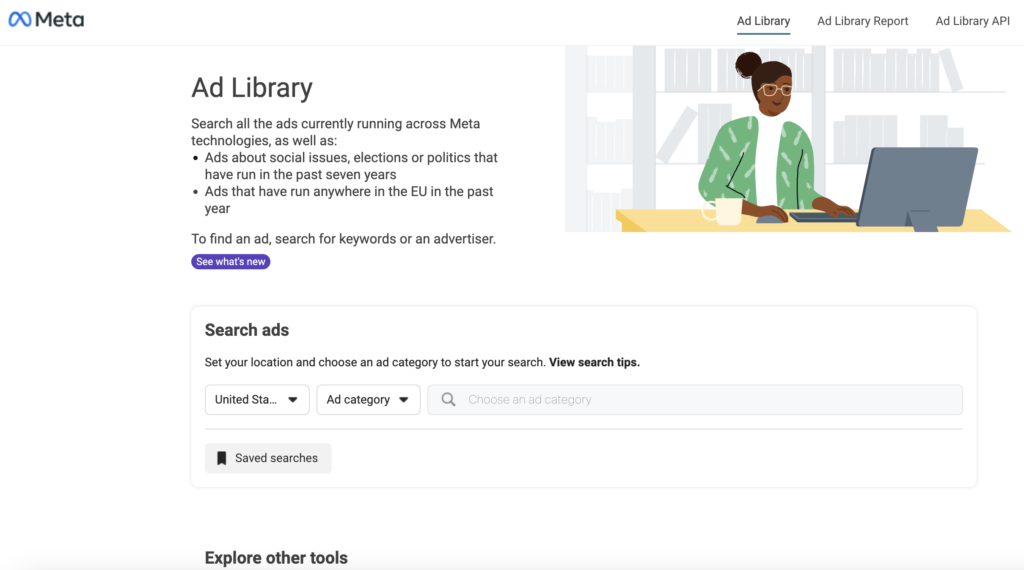

Meta ad library

First is the Meta ad library, formerly known as the Facebook ad library. This is the open database of all ads run on Meta’s platform. After the hot water Meta got into around ad targeting, they wanted to be more transparent with what companies were running what ads, so they published the Meta ads library.

Here, you can filter by any competitor’s facebook page, and see the history of facebook and instagram ads that they’ve run.

You can use this information to either test out new messaging, images, or steal what’s been successful for your competitors.

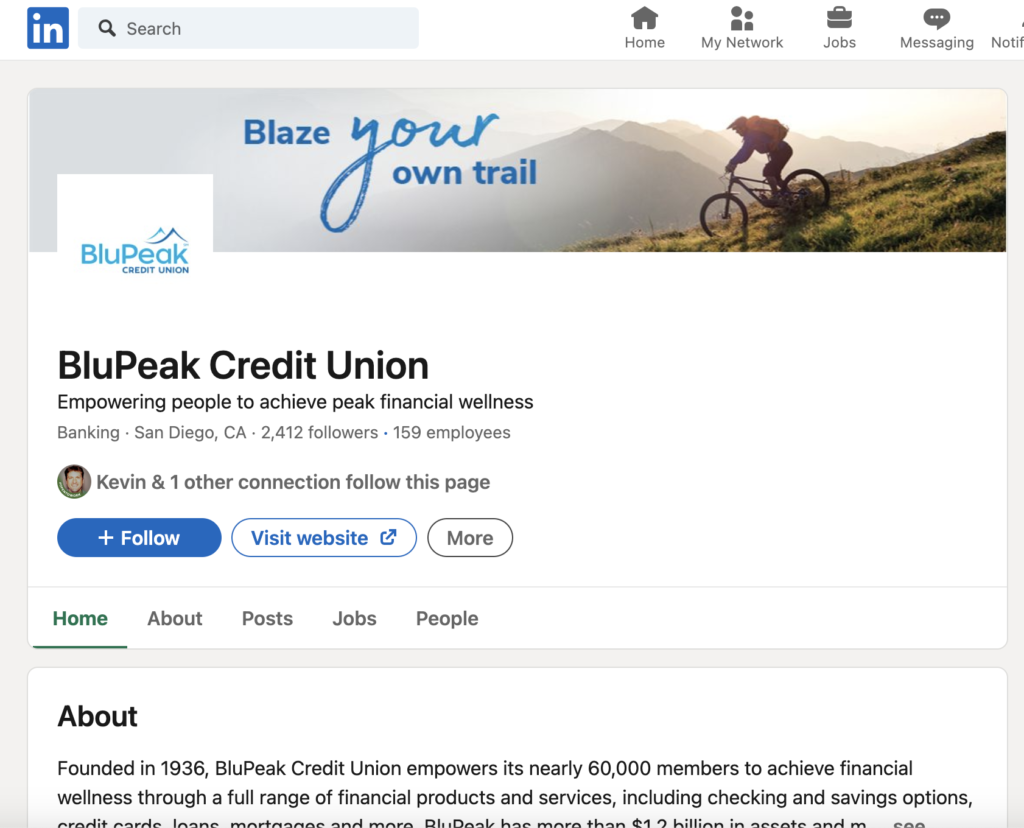

LinkedIn ads library

LinkedIn operates a little differently in their user experience, but you can still find any ad a company has run on LinkedIn.

First, go to the company’s business page. Next, click on “posts” found under the profile image and basic information. Next, there will be a tab that says “ads.” If the company has run any LinkedIn ads, they’ll be found there.

SEO & Google Ads (SEMRush + SpyFu)

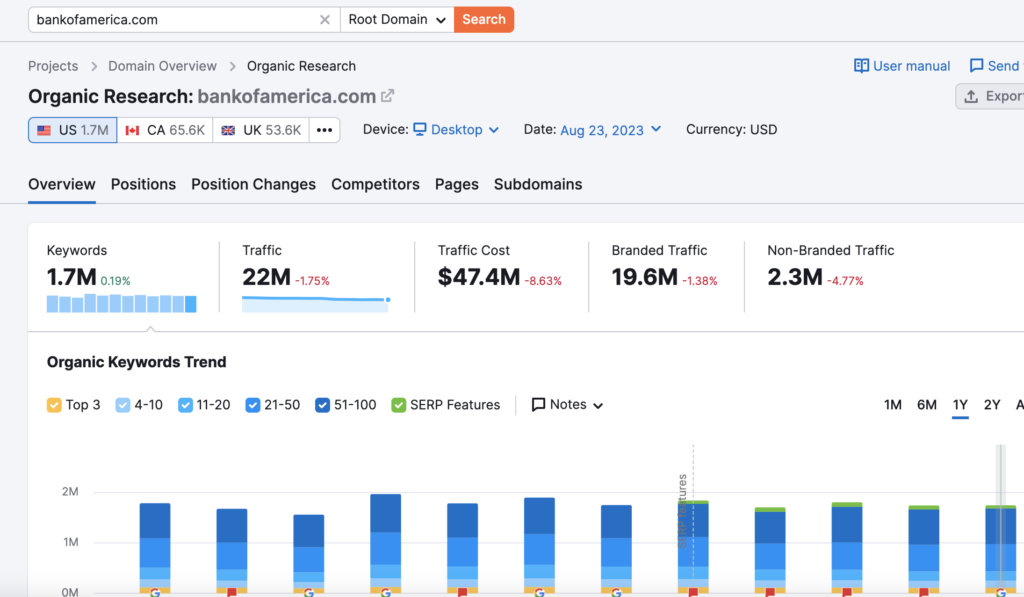

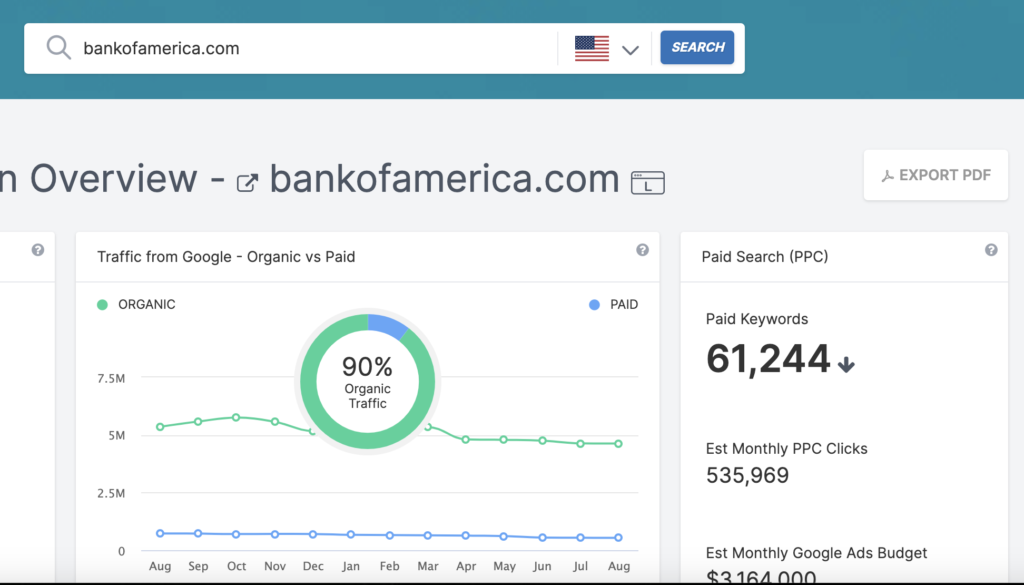

SEMRush is a great tool for SEO. It can tell you what keywords your competitors appear for when your target audience searches for something. It can also tell you what a competitor’s top performing pages are, and where they’re vulnerable. SEMRush will also tell you what the general demand is for a given topic nationally. It’s a must have tool for any content marketing campaign.

Semrush

Spyfu

Top 3 common trends seen in digital ads for banking

Omnichannel campaigns

Omnichannel marketing involves creating a cohesive and integrated experience across all of a customer’s touchpoints–think mobile phone apps, websites, browsing social media, and in-person interactions.

As customers increasingly expect seamless experiences across digital and physical channels, banks will need to adopt a more sophisticated approach to stay in front of their audience.

Sustainability and Social Responsibility

This is a recent trend that’s been popping up more and more in 2023. Banks have increasingly emphasized their sustainability and social responsibility initiatives in marketing campaigns. This is all about creating a positive brand image as customers become more socially conscious.

Open Banking and API Integration

The use of Fintech products that cross over into banking (think digital wallets) has been on the rise since P2P payment transfers became popular with Venmo and Square back in 2014. Now, consumers want to take advantage of fintech apps that can connect to their financial accounts and improve their financial lives.

A great example is credit repair apps that charge a monthly fee to a customer’s debit card and reports the payments to credit bureaus to improve credit scores.

Banks can leverage partnerships with Fintechs to gain greater reach, or even run targeted ad campaigns against an audience who’s interested in a related fintech app.

Overall, ads for banks is all about being relatable, building trust, and ensuring the ROI is positive.

If done rights, banks can run advertising campaigns that ultimately lead to stronger relationships with customers and greater success in the highly competitive financial industry.