First things first: defining what we mean by “Fintech Content Marketing”

Content marketing is a strategic (and data-driven) approach that focuses on winning (and retaining) high quality customers by creating and distributing relevant (and useful) content. A well-thought-out content marketing strategy for fintech startups will clearly demonstrate why a reader should become their customer.

You’ll notice the word “demonstrate” was used instead of “communicate” or “show” or “tell.” There’s a reason. Your content should never try to convince a visitor you’re the best option. They should come to that conclusion themselves.

You show website visitors your brand is the best option by helping them, not convincing them.

Content marketing should be focused on helping your audience first and foremost.

How does content marketing differ for Fintech?

At its core, fintech content marketing is designed to pique interest and drive leads. Most finance companies will use high-quality, educational blog posts or white papers. But let’s be honest, financial material can be boring, dense and hard to relate to.

Add this to the fact that the fintech industry is becoming increasingly competitive, creating a content strategy that puts you ahead of your competitors becomes more and more arduous.

Focus on empathy and creativity to out-perform your competition

But if fintech brands use creativity and empathetic thought processes, their content can be interesting and appealing, and lead to better engagement from their target audience. As a bonus – fintech startups focused on SEO growth will see better performance by creating content their audience actually finds useful. As a matter of fact, Google released a broad algorithm update focused on rewarding useful content.

The benefits (and ROI) of content marketing for fintech brands

Finance companies are more focused on ROI than other industries – and rightly so. High competition, expensive customer acquisition costs, and much harsher consequences for legal fo paux make heightened scrutiny a more necessary evil.

So what are the benefits of content marketing?

- Expand to new audiences: Consumers (and customers) are consistently searching for solutions to their problems. In fact, over 3.7 million Americans a month search Google for answers to questions about credit cards alone. Looking to answer questions your potential customers have will open up new leads for your brand.

- Strengthens your relationship to existing customers: Do your customers have questions about your product? Or can you help them achieve their goals? If so, you’ll transform customers into loyal brand advocates.

- New sales through brand loyalty: People move. 65% of American workers are actively searching for a new full-time job right now. If you are able to create a loyal following, when people change jobs, they’ll come back to your brand and bring you along with them.

- Increases brand authority: The fintech industry is exceptionally competitive, and if you’re consistently producing high-quality content, you’ll be viewed as a trustworthy and credible thought leader over time.

- Increase high quality leads: Conversions and leads start with education. Fintech content will start readers down the customer buying funnel and encourage conversions at every step.

How to create ROI positive content marketing campaigns

1. Quickly scale content with a knowledge center instead of blog posts

A pro tip: at the early stages, instead of slowly producing long and expensive expert blog posts, create a knowledge center. This can include a glossary of industry-specific terms or just quick answers to common questions your potential customers have. This will help quickly create content at scale, quickly gain SEO authority (and traffic), and give visitors good intro to your brand.

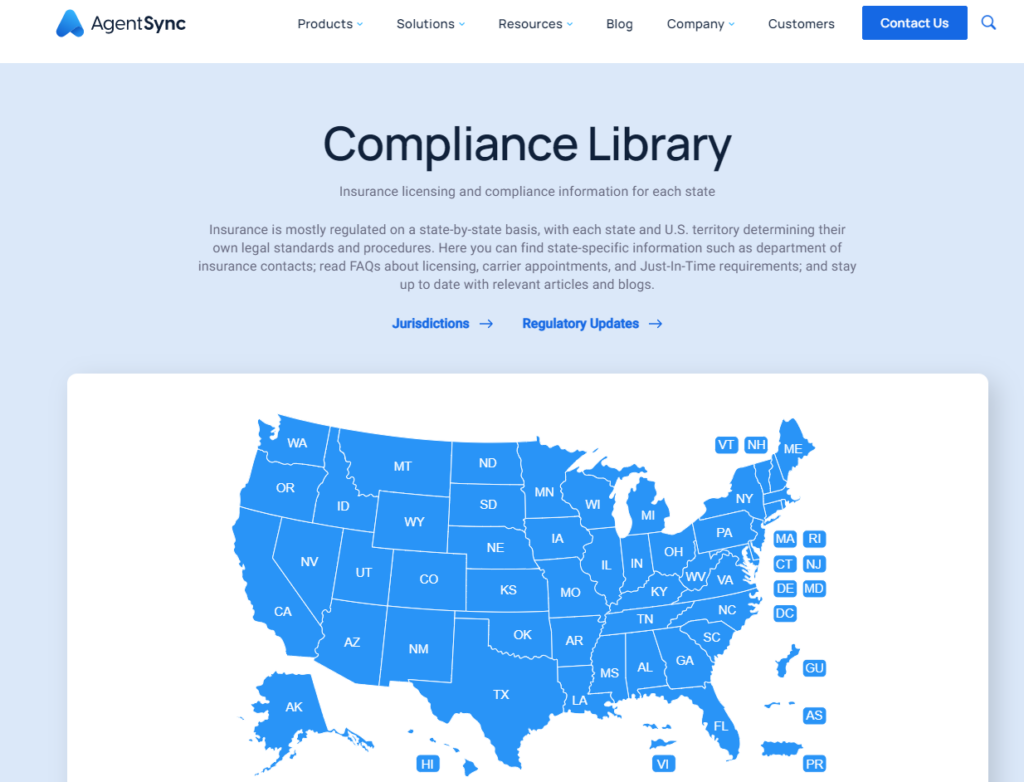

EXAMPLE: Agentsync.io built a state specific resource center for insurance carriers

2. Make something customers can use right away

Square (now “Block”) had a new product they wanted to introduce to entrepreneurs – Square Invoices. But at the time the industry was still manually emailing PDF invoices. So they met their audience where they were, and created an invoice generator. Then used that to introduce people to their (easier to use) product.

EXAMPLE: Square’s free invoice generator

3. Provide useful content and it will drive results

By producing content around sometimes confusing concepts, and making those complex concepts digestible and actionable – meaning users understand it enough to do something about it – you can create vast amounts of traffic and loyal customers.

As a way to make financial information educational and accessible, Chime has created a blog and resources page that breaks down complex financial concepts into digestible chunks. Each topic is broken down into easy-to-understand language in how-to guides, listicles and infographics

EXAMPLE: Chime creates an easy to understand resource guide for its readers

4. Providing interactive content can drive sales qualified leads

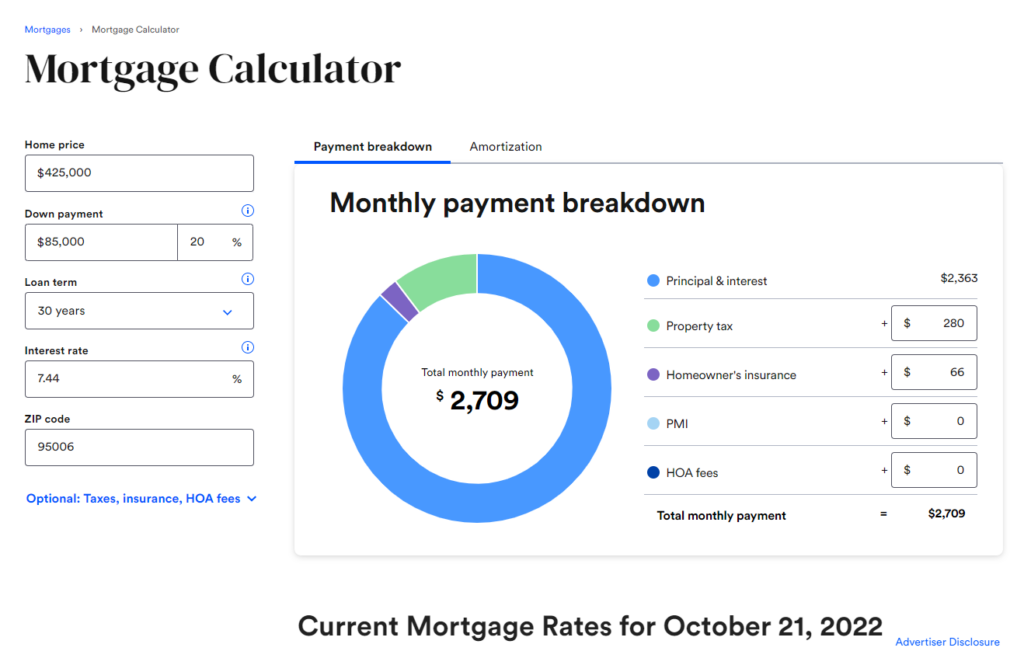

The fintech space is full of complex information that can be hard to understand. So it’s important for companies to find ways to make their fintech content more interactive so readers can understand and act on your engaging content (and user experience).

EXAMPLE: Bankrate uses their interactive calculator combined with quality content to drive leads

Some quick pro-tips about content production for Fintech Startups

1. Talk like a human: Embrace being conversational and approachable. People resonate with that. Remember, people want to read content from people — not robots. Imagine your brand as that smart friend at a bar.

2. Include legal (and compliance) early in content development: Lawsuits can destroy your fintech brand. The last thing you want to do is run into trouble with your legal and compliance departments. Creating content that’s not compliant won’t just be legally dangerous, but it could hurt SEO rankings as well. So involve your compliance team in both the ideation phase and the review phase of content production.

3. Make sure to include your SEO team: Fintech brands that invest in SEO end up creating a virtual moat around their business. That’s how Credit Karma became a unicorn. So involve your SEO team to help discover topics your target audience is searching for, and build content to solve their needs.