VCs and investors only invest in about 1% of all the startups that pitch them. Some even less than that. So what do they look for in the top 1% of startups they invest in?

What is a startup pitch deck

A startup pitch deck is a presentation that founders of a startup use to pitch their business idea to investors. The presentation typically includes an overview of the business, its mission and goals, the problem it solves, how it plans to make money, and a description of the team.

While the goal of a pitch deck is to persuade investors to invest in your startup, sending your pitch deck to an investor is really about piquing their interest, and getting them to want to meet you. The presentation should be short and concise, and include clear, easy to understand visuals that help explain the business.

If you use vivid storytelling and compelling visuals, you’ll have a higher chance at securing critical funding for growth.

The startup pitch deck outline (what to include)

After collecting data on over 1,000 pitch decks, here’s what is most commonly asked for by VCs. We’ve emphasized the most commonly asked for pages of a startup pitch deck:

- Intro

- Problem you’re solving

- What your solution is

- Market size

- Business Model you want to use

- Traction you’ve gotten

- What’s your pipeline look like / any sales?

- 3-5 year projections

- Your go-to-market strategy

- Who’s your competition

- Who’s the team and what’s their bonafides?

- What are you asking for?

You’ll be lucky if [investors] can remember even 1 or 2 of those points in the context of 100 other companies also presenting [to them].

Kevin Hale from Ycombinator (a startup accelerator in Silicon Valley)

If you just communicate your points clearly, you’ll do better than 99% of startups.

1. Your intro

Keep in mind the most commonly successful pitch decks had between 10-12 pages maximum, including your intro. The Intro slide should just be a simple slide with the company name or logo, the CEO’s name, and some contact information.

If you have a snappy one-liner that explains what you do, you could include that, but odds are that could get confusing, and you’ll be explaining your solution in a following slide anyway.

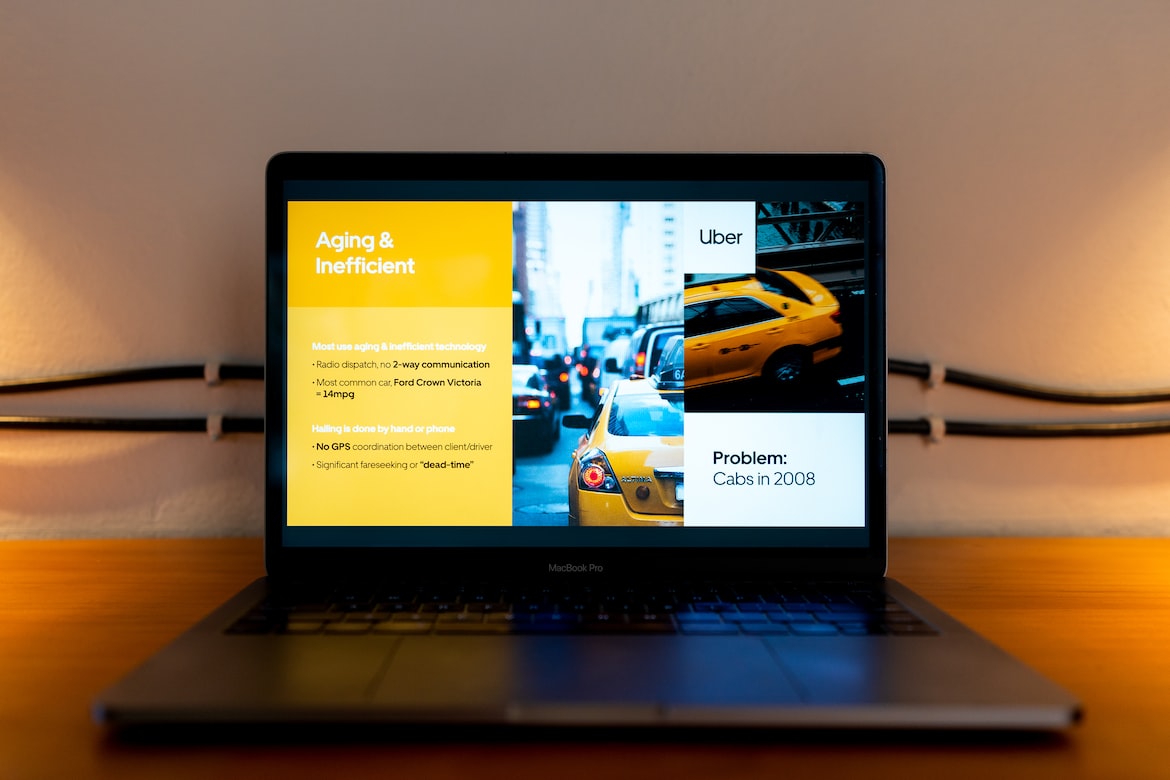

2. Problem you’re solving

The Problem slide is your moment to make investors connect with and understand why the problem you’re tackling really needs solving. Give investors something real they can wrap their heads around. Crafting great pitches requires masterful storytelling–it needs to be short, simple, powerful, and intriguing.

3. Your solution

The Solution slide is where you talk about your solution to the problem, and why it’s so great – use use cases if possible. How was a customer’s life changed by using your product to solve their problem?

PRO TIP don’t dive too deep into your product and features. This is a common mistake that costs startups. Focus on impact – time saved, pain relieved, money saved, revenue generated.

4. Market Size

When it comes to your market, size does matter. Use the Market slide to demonstrate just how vast and expansive your target audience is. It’s important to also identify which segment you’ll be tapping into first – this will serve as a foundation for further growth down the line.

Things to make sure you include:

- Total Addressable Market: This defines the total potential for a market which in this case would total amount spent by the population on groceries

- Total Serviceable Market: This is the percentage of the Total Addressable Market that engages in online transactions

- Total Target Market: This is the percentage of the Total Serviceable Market that meets the startups Target Market.

PRO TIP: Don’t misconstrue the size of your market just so it seems bigger than it really is. Most startups are not going to take on a trillion dollar industry. Get specific with your market. The fastest way to lose investor confidence is to be untruthful, or to appear as if you don’t understand the market you’re trying to enter into.

5. Business Model you want to use

Understanding your unit economics can be essential to knowing and understanding how you make money – which is why the Business Model slide offers a great opportunity to dive into this information.

Make sure you know these key factors inside-out before presenting:

- Expected recurring revenue: the amount of “guaranteed” revenue your business brings in over a defined period of time; this is typically contractual / subscription-based.

- Unit economics: Think of it as the profit-and-loss statement for a single unit sold, or a single customer sold to, before accounting for more general company-wide expenses. Make sure you know your customer acquisition cost (CAC), the customer lifetime value (LTV), and the CAC payback period (the amount of time to recoup the customer acquisition cost).

- Churn: The percentage of existing customers that leave, or unsubscribe from your service, over a period of time.

- Runway: How long your company has before running out of capital.

- ARPU: Average revenue per user. Essentially the average amount of revenue generated per user (or customer).

- Revenue per employee: The ratio between revenue and employee headcount.

6. Traction you’ve gotten

This is your chance to brag. Talk about your growth over some period of time, but make sure to focus on non-vanity metrics (like revenue growth, profitability, user growth, etc.). Remember anything over 0 is something worth talking about – especially at pre-seed and seed stage.

7. Pipeline and sales

If you’re a B2B SaaS company, the list of potential customers you are in talks with and at different levels of conversations. This is also a chance for you to talk about your sales cycle – how fast do you close deals? What is your close rate? How long is a sales cycle? What’s the average value of a sale?

PRO TIP: If you are showing logos/names of customers who committed to buy your product to show you have traction, make sure they are actually serious about buying your product. Chances are they will be contacted about you during an investment firm’s due process.

8. 3-5 year projections

3-5 year projections can be invaluable in helping VCs map out your company’s growth trajectory – enabling them to accurately assess potential paths forward.

But more than that, it’s about showing them how you think about and plan for the future and scaling your company. VCs want to know what assumptions you’re making, and how strategic will you be to accomplish that scale.

9. Your go to market strategy

Go-to-market slide talks about your customer acquisition strategies (This is our favorite slide). Talk about the different channels or ways you are planning to get customers.

If you need help with that, hit us up!

10. Competition

In the Competition slide, you have a chance to show off your knowledge about competing forces in the market – both direct and indirect. Focus on what makes you better than them; don’t focus their strengths – point out where they don’t measure up and how you take advantage.

11. Who’s the team?

Brag about your team and what you’ve done before. Don’t pass over if you ever worked on anything together – serial entrepreneurs are less likely to make the same amount of mistakes as first time founders. If your team has successfully worked together, even better. You can add your advisors, but they aren’t your team. Focus on those that are in the trenches with you every day.

12. The ask

Don’t be shy. Give them a number. And tell them why you need and it and what it’s going towards.

13. Ending slide

Basically the same as your intro slide and add your contact info, and a summary of why you should get investment.

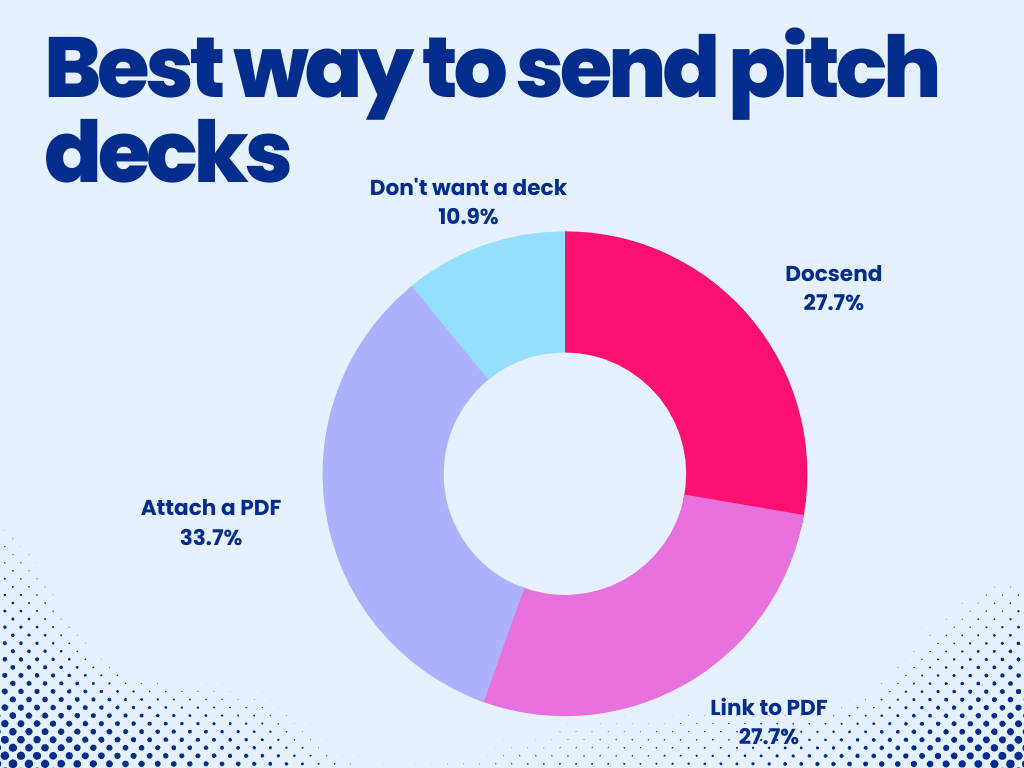

What is the best way to send pitch decks to investors?

By a wide margin, most VCs prefer you send an email with an attached PDF of your pitch deck. Don’t lock it behind a non-disclosure agreement or a password. Just send them the PDF.

PRO TIP: VCs hate non-disclosure agreements (NDAs) and on principle won’t sign them. You don’t want them to anyway, as venture capital is a networking game, and often if they don’t invest, they’ll share it with a connection who might.

Examples of great startup pitch decks

The perfect startup pitch deck template

DocSend as a great pre-seed pitch deck template that should help cover all your bases. It doesn’t include everything we talked about, but it does carry the majority of it. Their template is also backed by data on thousands of pitch decks that run through their system. So this template is the result of their analysis on what to include from the most successful pitches that won investment.

Remember!

Vivid storytelling, compelling visuals, simple messages, accurate data, and traction. If you include those five things, you’ll have a very good shot at securing funding for your startup.